Big four power companies earning $7 million every day

The ‘big four’ power companies made a combined net profit after tax of $520m in the last financial year

Ella Bates-Hermans/Stuff

The “big four” power companies are earning more than $7 million every day while some households struggle to heat their homes, according to Consumer NZ.

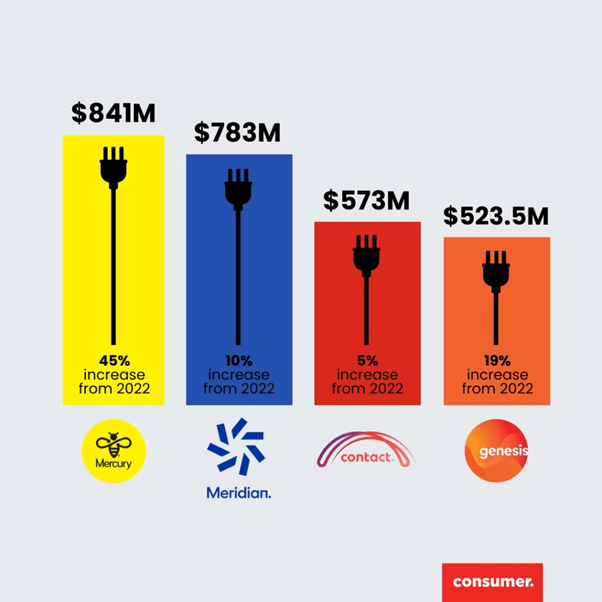

According to their financial reports, Meridian, Contact, Genesis and Mercury had combined earnings of $2.7 billion over the last year – about $7.4m a day.

But while the consumer watchdog says the numbers are a bad look for the generation and retail power companies (gentailers), the industry says it is ploughing earnings back into developments to help New Zealand transition to a carbon-zero economy.

Consumer NZ chief executive Jon Duffy said 60% of New Zealanders were concerned about the cost of energy and “the optics of huge profits at the height of a cost of living crisis aren’t great.”

“We estimate 40,000 households have gone without power at some point in the past year because they couldn’t afford to pay,” Duffy said.

The Government is fast-tracking the consent process for new wind and solar energy projects, with Prime Minister Chris Hipkins saying it could eventually lead to cheaper power prices

“New Zealanders have the ability to save on their power by shopping around, but that only goes so far. More work needs to be done to ensure consumers can have confidence our electricity sector is working to their benefit.

“We acknowledge that profits are a healthy and normal part of business, but there’s a question around what is excessive.”

Energy Retailers Association chief executive Bridget Abernethy said its members were playing a key role in New Zealand’s transition to a zero-carbon economy and investing heavily in projects to make that happen.

Financial records show the “big four” companies, which provide power to about 85% of the market, made a combined net profit after tax of $520m in the 12 months to June 30. That was down 66% on combined profit of more than $1.5b the year before.

“We’re ploughing earnings back into developments. Market analysts estimate we’ll invest around $4 billion in renewable generation in the next five or six years,” Abernethy said.

“ERANZ members are very conscious of the cost pressures Kiwis are facing and have programmes in place to help those most in need. It’s also worth noting that increases in household power bills have been well below the rate of inflation over the past five years.”

Recent Consumer NZ research showed 19% of households had trouble paying their monthly power bill in the past 12 months, while 12% reported being cold because they had to cut back on heating due to cost.

The survey also found 6% of households had to switch to a more expensive prepay plan because they had had trouble paying their electricity bills.

Those on prepay power plans paid about 15% more for their power, and were automatically disconnected if they ran out of credit, Duffy said.

“When faced with a choice between paying more for power, or going without power, in reality there is no choice.

“We’re ploughing earnings back into developments. Market analysts estimate we’ll invest around $4 billion in renewable generation in the next five or six years,” Abernethy said.

“ERANZ members are very conscious of the cost pressures Kiwis are facing and have programmes in place to help those most in need. It’s also worth noting that increases in household power bills have been well below the rate of inflation over the past five years.”

Recent Consumer NZ research showed 19% of households had trouble paying their monthly power bill in the past 12 months, while 12% reported being cold because they had to cut back on heating due to cost.

The survey also found 6% of households had to switch to a more expensive prepay plan because they had had trouble paying their electricity bills.

Those on prepay power plans paid about 15% more for their power, and were automatically disconnected if they ran out of credit, Duffy said.

“When faced with a choice between paying more for power, or going without power, in reality there is no choice.

However, Abernethy said prepay services gave customers flexibility to manage their income and some liked the real-time visibility of their energy use and payments.

“Anyone struggling with their power bill is likely juggling other debts as well, so it’s a way of helping customers manage debt overall, not just their electricity.”

Government agencies and budgeting services recommend prepay connections to vulnerable customers where it was appropriate and prepay could be a valuable tool to help some households manage overall cashflow and expenses, she said.

“Disconnection is always an absolute last resort for our members after exhausting other options. We encourage people struggling to pay for their power to talk to their provider – our members are committed to working with customers to find solutions to help them stay connected.”

Abernethy said retailers recognised they had a responsibility to support vulnerable customers and ensure a customer’s debt level didn’t spiral out of control, and a robust system was in place for working with customers having difficulty.”